The majority of the coverage around fake news has focused on its political influence, but this has begun to seep over into the corporate world.

In the lead-up to the US presidential election, Trump supporters called for a boycott on Pepsi products over a quote its CEO never actually made. Twitter uses claimed Indra Nooyi, CEO of the soft drinks manufacturer since 2006, told Trump fans to “take their business elsewhere.”

In order to uncover more about the potential damage fake news can cause, we analysed the response to the Pepsi incident to understand: what effect does fake news have on corporate reputation? Can fake news impact on a company’s stock price? And how should media monitoring and analysis companies handle fake news?

What effect does fake news have on corporate reputation?

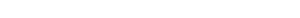

As this specific fake news story was very US-centric, we can analyse the immediate impact it had in Pepsi’s home market. During Q4 2016, Pepsi’s average sentiment score was slightly above neutral (5.5*), indicating that the company was generally perceived positively in this market.

However, on 13 November The Last Refuge published a widely shared piece stating that Pepsi’s CEO had told Trump supporters to “take their business elsewhere”. The timing of these reports directly correlate with a sharp dip in public sentiment towards Pepsi. This trough represents a 35 per cent fall below the average US sentiment score during Q4 and shows it was significantly ahead as the single most damaging incident for Pepsi during this period. This shows there was a clear impact on Pepsi’s domestic reputation, but how did the issue filter through to the company’s international reputation?

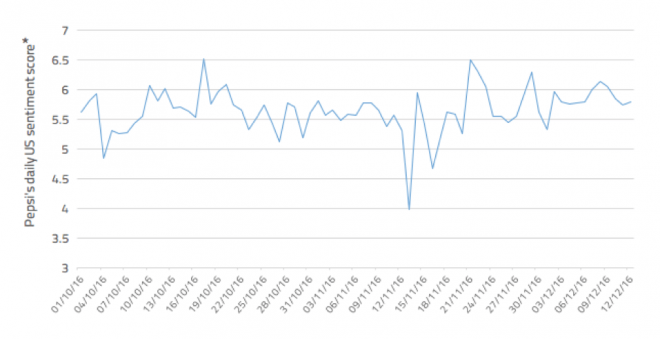

If we extend the timeframe to look at Pepsi’s global sentiment trend across the full year, it is clear that despite the fake news incident only relating to a political issue in one country, it had such a significant impact that it was still the most negatively impactful event for the company throughout 2016. To put this into context, the second worst dip in sentiment was on April 18, when Pepsi announced their sales had fallen for the sixth straight quarter, which might be expected to draw more widespread concern and negative coverage. Due to the geographically targeted nature of the fake news incident, the global negativity on November 13 was softer compared to the impact in the US alone. However, the fake news related lowest point in Pepsi’s year was still 19.5 per cent below the company average. This shows that not only can fake news affect reputation; it can actually be the biggest single driver of negativity towards a company.

Daily US sentiment score for Pepsi Q4 2016

Can fake news impact a company’s stock price?

We have seen that fake news can cause major reputational damage to a company, but how does this affect share price? In the weeks leading up to the fake news incident, Pepsi’s stock price averaged around $106.58. Pepsi’s stock price took a significant hit on November 10, the day after Trump won the presidential election, triggering the initial circulation of the fake quote. In the weekend that followed, the quotes were widely shared on social media, resulting in a further decline in share price when the markets re-opened on November 14.

“It is clear that companies can experience significant reputational and financial damage from fake news.”

In the weeks following the circulation of the fake quotes, there is a clear difference between Pepsi’s sentiment trend and its stock price. Sentiment towards Pepsi recovered well within five days, and its subsequent average reputation score has been higher than the months leading up to the fake news story. However, Pepsi’s stock price continued to decline for almost three weeks, before it began its recovery at the start of December. Even a month after the quotes were recognised as false, Pepsi’s stock price still trails its previous average. This indicates that if it is quickly refuted fake news may not cause lasting reputational damage, but the subsequent impact on stock price can take longer to restore.

Daily global sentiment scores for Pepsi in 2016

How should media monitoring and analysis companies treat fake news?

In a recent interview with Thomson Reuters, alva’s CEO Alberto Lopez was asked how companies can tell what stories are real or fake and how this factors into media monitoring and media analysis.

While it might be tempting to ignore or remove stories based on their lack of authenticity, the analysis above shows that they can cause as much, if not even more damage, than real stories. The important factor is amplification. If a fake story is amplified, then it will still create a perception and provide confirmation bias for those with a fixed stance on a subject. This can be for a number of reasons. Not everyone who read or shared the original fake content will be aware of the subsequent discovery that it was incorrect. On top of this, the post-truth culture is so prevalent, that even if some people do become aware of a claim being disproven, they are inclined to reject these assertions as false as they don’t trust the origin or if they challenge their preconceptions.

Most genuine news sites will update an erroneous article if it is found to be inaccurate and acknowledge the correction. However, as many fake news stories are deliberately made up or skewed to fit an agenda, the original source will often not correct the statement, be slow to make changes, or word the amends in a way that continues to project the original accusation. This means that there is the potential for fake news to have an extended lifespan as the original inaccurate claims will still be available long after the media attention highlighting the inaccuracies has moved on.

It is therefore crucial for corporations to understand the various stakeholder perceptions, both genuine and false, that make up their overall reputations. If these perceptions are based on false accusations, then the company can move to mitigate the damage by challenging the authenticity and potentially even gaining positivity by providing proof to the contrary. It is also important for companies to be notified and respond quickly, as this can effectively restore reputation and potentially reduce the longer-term damage to stock price. However, it is also vital for a company to be able to filter out the noise created by the less impactful fake stories, so they only focus on the content likely to cause damage.

We achieve this by objectively scoring the sentiment of a piece of content, but also assigning the source with an influencer score. If it is from a traditionally trusted source, then it is likely to result in amplification and will be weighted as more important. If a less established source is also displaying significant amplification, then this will boost the influencer score on this occasion to reflect the impact it is having. This enables companies to understand which content has the most potential for influencing stakeholder perceptions of their brands, regardless of the accuracy of the source material.

Comparison of Pepsi’s sentiment trend with its NYSE share price

What we know

By analysing the response to Pepsi’s fake news experience, it is clear that companies can experience significant reputational and financial damage from fake news. While public sentiment towards Pepsi recovered well within a week, the impact on stock price is still evident over a month after the incident. It is therefore important for companies to be aware of anything being said about their brands if it is receiving widespread amplification, regardless of its providence.

The majority of recent corporate fake news incidents have had political undertones. However, with the effectiveness of the strategy established, there is a danger that a company could be targeted for other reasons, either financial (manipulating share prices; generating online advertising revenue from the subsequent traffic) or emotional (dislike of brand or corporate leaders; disgruntled employees; highlighting an issue by creating a “poster boy”; etc.). Companies therefore need to have the correct resources that can filter out the inconsequential content, highlight the trusted content sources, while also alerting them to the most impactful and dangerous fake news.

A version of this article originally appeared on the alva website as How does Fake News affect corporate reputation?

Images: alva