Mergers and acquisitions (M&A) are generally understood to bring about an improved market position, an increased corporate footprint or superior product offering.

Before an M&A is completed, shareholders, analysts, employees and managers are bombarded with bold promises and superlative messages; these promises continue to pop up repeatedly M&A communications. The purchaser is perceived as dominating the deal and running the game. Therefore, the purchased party must be the opposite: a loser, correct?

Not necessarily. The purchased side can manage its own M&A communications just as positively as the purchaser side. There is a way to counter the all-too frequent submissive position of the seller and to credibly convey confidence in a better future, and it all starts by thinking that it is possible and making the necessary mind shift. Here is the story of a good sale.

Staying upbeat about downsizing

At some stage, we have all heard smeone talk about buying a larger home with a bigger garden, or buying a new car with greater performance. Perhaps we even envy them and are dazzled by their hyperbole.

On the other hand, our semantic value system provides negative connotations with moving into a smaller home or with buying a smaller car, even if that is the rationally better option for its financial, energetic or social benefits. This is exactly what makes it so difficult to have a divestiture come across positively in the corporate world.

Freeing up greater strategic power and increased financial resources for other activities or refocusing priorities with new strategic priorities can all be relevant reasons for a divestiture. “Mainly due to changing financing environments, complex coordination issues, and dramatically rising numbers of involved parties, corporate transformation can no longer be thought of as a special tool that’s only brandished once the wheels start falling off. It is an ongoing process that can deliver enormous benefits to your company” explains management consultancy Roland Berger.

In other words, a sale can be an opportunity for a company to put itself in the driving seat and optimise the performance of its operations. In 2006, the Harvard Business Review recommends companies to only carry assets that maximise value and to regularly “monitor whether there are buyers willing to pay a meaningful premium over the estimated cash flow value to the company for its business units, brands, real estate, and other detachable assets”.

Announcing a divestiture is like telling your spouse “I love you, but we had better break up in order for you to be happier with somebody else.”

While the purchaser is likely to be in an almost euphoric state, their “target” will feel disappointed, submissive, even lost. There is a fundamental belief that the purchaser alone dictates the new rules of the future. The collective and individual self-esteem of the purchased is affected when the purchaser, sometimes a long-term competitor, takes over. Switching status from competitor to colleague is a challenge, and well-performing teams have to demonstrate their capabilities all over again to a new boss. Anger and frustration at senior management are generated when a divestiture is received as a major break of trust. When the purchased party is a healthy performer or if there is a challenging social climate, some adversity among the purchased will be home-grown.

Because of the emotional shock generated by the announcement of a divestiture, most employees will experience fear for the future. To be purchased is frequently associated with synergies, another term for restructuring, dismissals and other cost-cutting measures. Across all the files we have worked on, job security has been the number one concern for employees, regardless of the seniority level or collar colour.

A research paper by human resources consultancy AOM Hewitt finds that, within a group of employees going through M&A with significant impact on their job, the percentage of highly engaged employees is cut in half: “By contrast, more employees appear to become highly engaged when their company makes an acquisition that has no impact on their job. The data also suggest that acquiring another organisation is easier on employees than being acquired. Thus, it appears it’s not just the M&A activity that influences engagement, but rather the extent to which the M&A impacts an individual’s job and whether one works for the acquiring organisation or for the acquired.”

Just the rumour of a potential divestiture can have disastrous effects. In one of our files, the senior management of a larger industrial group had decided to explore the potential sale of a regional business as just one of several options to turn around the activity. Therefore, they reached out to their organisation and asked the teams to compile data for the preliminary exploration study.

By the time we arrived, over 80 employees had already signed a non-disclosure agreement (NDA). As no further context had been provided, rumours about a potential sale spread like wildfire, the company was approached by several interested parties, including a direct competitor, and customers started to worry. We advised that the NDA should be lifted and the announcement made that the project was off the table for the time being. This lessened the pressure about the story and enabled the management team to explore more options with less interferences, ultimately generating greater value.

Whatever size of the business, mergers and acquisitions constitute a major moment in the history of an organisation and often leave profound stigmas among those affected. The impact on management and operations is significant as the potential change affects all existing structures, processes and people. On the purchased side, major decisions on investments, people or customers risk being put on hold until the new organisation stands, thereby affecting the regular course of activities.

"Whatever size of the business, mergers and acquisitions constitute a major moment in the history of an organisation."

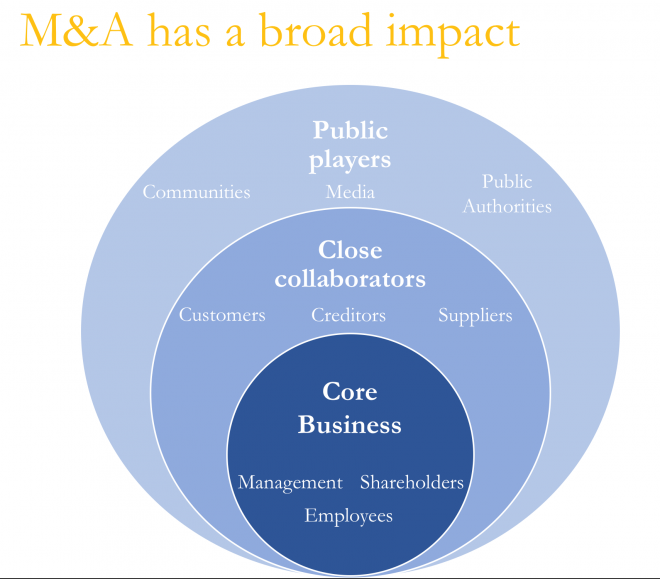

Further, new tasks relating to the future carve-out or integration will be allocated to individuals who already have plenty of responsibilities to deal with. A merger or acquisition comes on top of regular business and represents a significant, often underestimated, workload. The changes affect many other internal and external stakeholders, beyond employees or media. We refer to, among others, shareholders, customers, suppliers, potentially employee representatives, local communities, and trade associations, potentially even future candidates or investors, banks, authorities and so on.

On the purchased side, the role of the communicator is equally critical as on the purchaser side, but the scope is different. The top priority in a divestiture is to maintain stakeholder engagement. It is about maintaining faith in the business while managing with great uncertainty. The earlier the communicator is brought into the loop, the smoother the process can be managed.

Fear and anxiety do not stop at the hierarchical ladder

As usual, senior leaders set the pace. The greater their confidence in the future, the greater the chances that this confidence will spread throughout the organisation. Repeatedly, in turbulent times we have witnessed highly visible leaders inspire serenity across the workforce. They demonstrate that there is nothing to hide, that there are no grounds for fear. Their presence provides opportunities for small and larger interactions, and each of these interactions helps to build or maintain trust. That is why we always start working with the top executives to help them prepare their outreach.

On another large file with a multinational selling one of its business units, only a very small group of individuals at corporate level had been involved in order to maintain confidentiality. Several members of the management team only found out about the plan when the news about the potential divestment broke in the press. This generated an awkward situation between those in the know and those who had not been made aware and who felt left out.

The situation had put the established, trusted relationships of the team under great strain, putting the retention of key people at serious risk. Therefore, before we could dive into the preparations for the transaction, we worked out a plan with the business leader to rebuild the emotional connection with the entire management team and get it back on board.

Communicators have a key responsibility in helping senior managers tackle their concerns. As over-confident executives may struggle with credibly conveying trust, it is fine for an executive to say that she or he is also worried. What make the difference is how that person deals with uncertainty and how she or he brings that capability over as a skill to manage fear. While there are significant tactical or legal constraints, it is fear that makes managers make mistakes when communicating bad news to their team.

One way forward: make “bad” news just “news”

Against the odds, communications on a divestiture can use a sober win-win tone of voice. If the purchaser benefits from the acquisition, so does the purchased. Normally, a buyer is at least interested in one of the target’s assets: the people, the footprint, the know-how, the technology, the customer book, the reputation, the good-will, the future prospects and so on. Turning this around means that the “target” has actually done the job to be in such an enviable position. The target will find a better home, a stronger market position, additional funding to finance growth and more. There is no loser.

"If the purchaser benefits from the acquisition, so does the purchased."

As already mentioned, the announcement of a divestiture will generate a lot of emotion and uncertainty. As much as possible, the communicator will convey reassuring messages. But more importantly, the target will show how much it respects its employees by sharing as much information as possible upfront. Any proactive initiative putting senior executives in face-to-face situations or in direct interaction (via multiple online channels) with employees will help balance attitudes.

According to the Edelman Trust Barometer, 71 per cent of the public interviewed across 28 nations believe that employees are more credible that the company’s CEO4. With that in mind, the significance of internal communications becomes obvious. Talking to people normally, dropping corporate slang and paraphrasing legal lingua as much as acceptable are maybe the only pieces of advice that we can give. The rest can be summarised in a sentence: whatever the stakeholder, treat them as you would want to be treated.

What we have set out to demonstrate in this article is that communicators on the purchased side of the deal have a responsibility to manage their approach and get into the driver’s seat. And far from being apologetic or passive, being acquired is an opportunity for proactive, positive and engaging communications that strengthens the position of the purchased party.