Trust has never been so high on a company’s agenda and this is for good reason. Trust in business has become a scarce commodity. The stakes are high and risks well-known: disruption in the stakeholder eco-system, loss of reputation, and potential financial turmoil.

A recent self-assessment by corporate affairs professionals of how much their corporation is trusted by stakeholders depicts a context of uncertainty. Only one in five (21%) believes their company holds a very high amount of trust to operate in the best interest of society, according to findings from our new global survey of corporate affairs professionals. They are countered by the same proportion who report their stakeholders have very little or no trust at all in their business. In the middle, a majority holds muted feedback, which suggests they feel the trust barometer with stakeholders can go either way.

There is therefore a clear context of defiance for companies, and this is why it is increasingly urgent for them to manage trust like a risk, as an unsettled trust environment is an impediment to navigating business challenges effectively. More effective trust risk management first requires a better and stronger understanding of the meaning and the mechanics of trust, and of its core components in order to deliver a holistic strategy that can turn the risk into opportunities.

Using a framework that deconstructs the concept of trust to better understand what fuels it can help corporations to prepare and organise themselves to protect and grow the ever-fluctuant levels of trust in the business. Our point of view is that trust is built on three interconnected components:

Competency: Environmental performance in operations remains paramount here, followed by the capacity of companies to deliver good quality and reliable products and services. A clear business strategy delivering a strong bottom line and yielding significant economic and employment output is another important factor of trust from a competency perspective.

Integrity: Trust is also about the firm’s perceived behaviour when it delivers on the value proposition. The ability to do so with the highest levels of integrity and honesty is by far the most important single driver of trust. In relation to this, transparency and open communications about successes and failures are also key elements to demonstrate integrity through openness.

Benevolence: Less obvious to identify because it is more subtle, benevolence will mostly manifest itself through the way a company engages with society and convincingly demonstrates what its ethos is about. It can be observed from different angles such as building effective relationships with stakeholders or community engagement initiatives. Being purposeful is also very much linked to this idea of benevolence.

Each of the above pillars carries a significant weight in a company’s trust landscape, and it is the capacity to activate them simultaneously that will earn companies sustained levels of what we call thick, or opportunity-creating, trust.

The fact that the development of corporate purpose has become much more prominent on the agenda of corporate affairs professionals in the past five years (63% of respondents feel this way) shows we can expect this topic to gain more traction from its current level in the years to come.

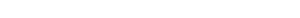

It might also be the case that, at the moment, most companies use corporate purpose more to drive internal cohesion and collaboration rather than to fuel trust levels externally. Nonetheless, a purposeful narrative gives a solid opportunity for businesses to shape their trust risk management strategy. And it is already very concrete. A strong majority of corporate affairs professionals surveyed (86%) say that their company has a stated purpose in place, and link it to clear and positive outcomes for their business.

For example, employee trust and engagement is seen as a clear outcome: almost all respondents surveyed (95%) agree that companies with a corporate purpose are better equipped to drive employee motivation to higher levels and secure greater employee retention. They may also have more chances to attract new talent.

Corporate purpose also gives a strong impetus for organisational optimisation by supporting companies’ long-term planning, and thereby is expected to help to edge ahead of competition. By being a strong motivational factor for employees, it also puts the organisation in an ideal mindset to implement change throughout the business.

For companies that communicate externally about their purpose, corporate purpose is also thought to be an effective binder to facilitate and align stakeholder conversations towards a holistic goal. And this is how the quintessence of purpose in a trust risk management strategy is manifested, as we saw how building effective stakeholder relationships is indeed a critical driver of trust.

The insights from our conversations with corporate affairs practitioners suggest that stakeholder engagement will actually be increasingly paramount in supporting companies’ journeys to enhanced trust risk management in many ways. Proactive external engagement will ensure better understanding of local contexts, help demonstrate enhanced transparency and inclusiveness, enable joint identification of risks and new business opportunities, or even support and guide the definition and implementation of a company’s corporate purpose.

As companies take steps towards a more integrated engagement strategy, the impetus of professionalising and systematising what is therefore increasingly set to become a strategic business grows bigger. The basics of engagement are here, particularly from a tactical perspective: email outreach, mapping, and hosting convenings are all fully in place or at least developing according to about two-thirds or more among companies surveyed (yet, this still leaves some room for improvement).

However, the move towards more innovative, focused and solutions-centred approaches, with the aim to lead value for both the company and society and that demonstrate a progressive shift from engagement to partnership needs to be accelerated. The development of campaign-based strategy to anchor meaningful discussion with stakeholders, or the establishment of stakeholder advisory boards, can bring engagement to this next level. Results show that there is still some way to go for these enhanced vehicles to become fully mainstream approaches in companies’ arsenals of engagement tools. It is noteworthy that among corporate affairs professionals who have already implemented a campaign-based strategy or who are willing to do so, three-quarters think they are effective to initiate and support engagement with professional stakeholders, indicating this format is likely to get more traction in the future.

There is clear evidence that trust risk management is driving some transformational changes within organisations by helping to redefine priorities, energising stakeholder networks, revamping corporate affairs as a value-driven function at the core of business strategy, and by enhancing cross-functional collaborations. These nascent transformations offer a fresh look into the future of multinationals, whose success and source of equity will rely equally on the management of both tangible and intangible assets.

To get more global insights from corporate affairs practitioners, read the full Managing Trust Risk report.

Main Image: Terry Johnston / Flickr